The Edinburgh private rental market remained busy throughout Q1 2023. As in previous quarters, rental stock levels were outweighed by tenant demand, driving up competition for homes, and keeping rent levels high.

The Scottish private rental sector (PRS) also continued to feel the impact of the Scottish Government’s Cost of Living Crisis legislation, with a cap on rent increases and freeze on evictions remaining in place.

You can find full details of the Cost of Living Crisis legislation in our previous article, New rules for landlords in Scotland – The Cost of Living Crisis Act, and further details of the legislation amendments in our article Cost of Living Crisis Act amendments: Scottish rent rises capped and eviction ban extended

Citylets’ quarterly reports provide important insight into the Edinburgh residential lettings market and the wider Scottish private rental sector. The reports also mean that we can benchmark our experiences and performance with letting agents across Edinburgh. We are pleased to again see our director Rick McCann quoted in Citlyets’ latest report, Quarterly Report Q1 2023 – Cap Trap.

The private rental market in Scotland

Citylets note that Q1 2023 was fairly calm across Scotland as a whole. There was welcome news for landlords, as the rent freeze was revised to allow a 3% increase, and mortgage rates dropped slightly. Tenants chose to remain in properties longer, benefiting from capped rent increases and avoiding the unrestricted rents for new tenancies.

The current imbalance of stock supply to demand is likely to continue or worsen, with landlords exiting the sector and with fewer tenants moving on to home ownership.

Average Scottish monthly rents are now at a new all-time-high, surpassing £1,000 for the first time, at £1,007 per month – a rise of 12.4% year on year.

The Edinburgh private rental market in Q1 2023

Citylets’ report found that Edinburgh letting agents all noted the disparity between property supply and tenant demand. Most noted a slowed turnover of tenants, who, instead of moving, are avoiding the fierce competition for properties while benefiting from the current rent cap.

Edinburgh may see some additional stock capacity as a result of the new sort-term let legislation. This legislation is expected to vastly reduce the number of holiday lets in the capital, with some owners likely to consider a move to long-term residential letting.

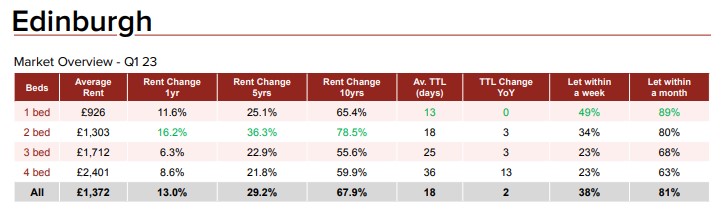

Edinburgh’s private rental market performance through Q1 showed a 13% year-on-year increase in average rents, driven by the competition for properties and perhaps, too, the pressure landlords may feel to increase rents substantially at new tenancies in order to manage the rent cap.

- Average rents increased by 13% year on year

- 81% of all properties were let within a month

Our experiences: At Home In Edinburgh

The continuing shortage of all types of PRS properties in Edinburgh is making finding a home very difficult for many tenants. In addition, we found that upward pressure on rents continued in Q1 due to limited supply and landlords maximising rent rises between tenancies to mitigate against the in-tenancy rent increase restrictions set by the Cost of Living Crisis Act.

Furthermore, we saw reduced turnover of our existing stock as tenants chose to remain in properties with rents below market rent levels. We expect more movement once rent restrictions are lifted.

Our focus during Q1 has been twofold – helping landlords with increased mortgage rates to manage expenses and analysing the EPC ratings of our portfolio ahead of the minimum EPC requirements coming into force in 2025.

Thanks to the new short-term let legislation, we have been receiving enquiries from property owners who wish to consider alternative options for their properties. We’ve been pleased to welcome several onboard as new long-term residential landlords.

Interest in Edinburgh property investment from overseas landlords has remained higher than usual over the last two quarters, and we’ve been pleased to assist in sourcing properties and bringing them to the market.

Our expert team is here to help

We are experts in the Edinburgh private rental market, and our friendly, professional team are here to help with any queries or concerns. We know that many landlords are feeling the impact of the Cost of Living Crisis legislation, despite the buoyancy of Edinburgh’s private rental sector, and we are here to guide and support you.

Edinburgh’s private rental market is robust, withstanding current and recent challenges, and there is currently a high demand for rental properties. If you have been considering an Edinburgh property investment to capitalise on this strong rental market, or if you’re considering a move from short-term to long-term letting, then it’s worth noting that the current rent caps apply to existing tenancies, with a reduced impact on new tenancies.

Get in touch with us if you’d like to chat through any queries, or if you’d like to use our free, no-obligation property-sourcing services or buy-to-let property assessments.

Contact us via email at [email protected], call us on 0131 229 4001, or pop in to see us at 39 Warrender Park Road, Marchmont, Edinburgh, EH9 1EU.