Citylets’ Q4 2018 report on the private rental sector (PRS) is out – and it’s more positive news for Scotland, and Edinburgh in particular. Landlords in the capital are seeing the highest average monthly rents in the sector, as the city continues to show strong growth.

Here’s our round-up from Citylets’ report, and what it means for landlords in Edinburgh.

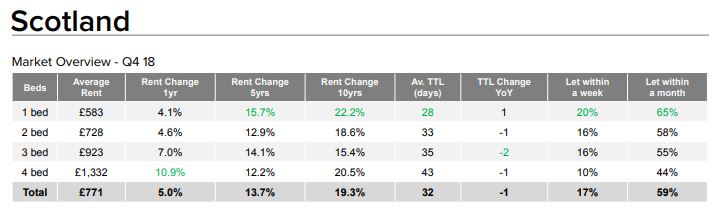

Scotland’s private rental sector

Average rents: Rents in Scotland were up on Q4 2017 by a notable 5% overall, year on year, at an average of £771 per month.

Average time to let: Properties took an average of 32 days to let, one day quicker than in 2017. 17% of properties were let within a week and 59% were let within a month.

Edinburgh, Glasgow and Dundee all maintained their increasing trend in rents, while Aberdeen saw a decrease of 5.3%, year on year – due in part to the excess of stock on the market.

Overall, three and four bed properties continue to see the highest annual rises, at 7% and 10.9% respectively. This supports the view that more families are entering the PRS. Indeed, the report notes a recent estimate of 90,000 families living in the PRS, making up 25% of households.

Adrian Sangster, of Aberdein Considine, observed that 2018 was a year of transition for the Scottish PRS, as the sector continues to adapt to the new Private Residential Tenancy (PRT) regime. During Q4 agents also had to prepare for the introduction of the Letting Agent Register, and the sector saw more landlords leave due in part to the phased changes announced in the 2015 UK budget.

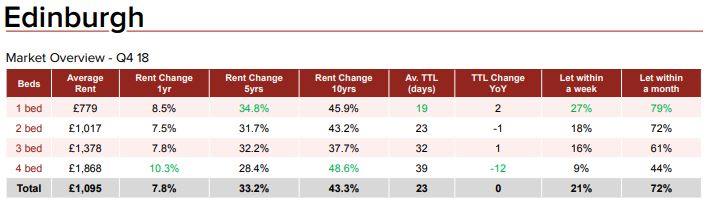

Edinburgh’s private rental sector

Average rents: Rents in Edinburgh were up on Q4 2017 by 7.8% overall, year on year, at an average of £1,095 per month. This is up significantly on 5 years ago (33.2%), and on 10 years ago (43.3%).

The biggest increase in average rent in Edinburgh was for four-bed properties, up 10.3% on 2017 and up 48.6% on 10 years ago.

Average time to let: Properties took an average of 23 days to let, showing no change from 2017. The majority of properties were let within a month (72%) and of these, 21% were let within a week. For one-bed flats the time to let reduces to an average of just 19 days, with 79% let within a month and 27% within a week.

Edinburgh has now seen over eight years of positive annual rental growth, and the report notes that the 7.8% increase in average rent in Q4 2018 has taken the sector to levels not seen since 2015 – 2016, led by strong demand for all property types.

Charles Inness, of Glenham Property, noted that the PRS has seen growth in Scotland – despite decreasing in the UK as a whole. The recent Buy to Let Britain report noted an increase in value by 11.9%, year on year. The average yield in Scotland of 5.3% is also higher than the UK average of 4.4%. Inness attributes Edinburgh as the driver of much of this growth, as the city continues to be the most prosperous outside of London, with a growing population.

Opportunities for buy-to-let investors

ESPC’s January 2019 house price report provides some good reading, highlighting areas for potential opportunities for buy-to-let investors.

According to the report, the average selling price within Edinburgh rose by 5.1% between November 2018 and January 2019 (£262,911 compared to £250,103 last year). It is interesting to note that the average selling prices of three bed houses in Costorphine, Clermiston, South Gyle and East Craigs rose by 15.7% compared to last year, mirroring the rise in three bed property rents in the PRS.

Further to this, the report highlights that the average selling price in Liberton and Gilmerton has dropped by 17.3% compared to this time last year. Coupled with the continuing strong and increasing demand for three bed properties in the PRS, this could provide some real opportunities for anyone considering making a property income investment.

Jamie Fraser-Davidson, ESPC, advised that there was a continued increase in the numbers of homes coming to market compared to last year, with a significant annual increase in sales volume, indicating that buyer demand is still relatively strong at present.

Fraser-Davidson also noted that average selling process are still increasing in comparison to last year, highlighting two bed flats in the New Town and the West End which saw a 21.7% increase in average selling prices year on year. There is strong demand from flats here, as an area which attracts those looking for city centre living and buy-to-let investors.

Good news for Edinburgh landlords

Charles Inness notes that strong demand for good value properties has continued across the board in Edinburgh, with HMOs and one bed flats performing particularly well. The market is demonstrating resilience in the face of political and economic uncertainty and industry experts remain optimistic that the PRS will continue to perform well into 2019 – offering opportunities to those considering buy-to-let investments.

The continued strong rental growth, coupled with capital growth, means that Edinburgh remains a strong location for buy-to-let investments.

Next steps for potential investors

If you’re considering growing your rental property portfolio, or looking to enter the private rental market, then you can read Citylets’ report in full here, and ESPC’s report in full here.

Remember that we offer a free, no-obligation, Buy-to-Let Assessment service – this analyses a property’s potential for long term lets on a PRT and short term lets on a holiday let contract, and provides you with an expert assessment. Our friendly, professional team is always happy to help, so if you’d like to start with an informal chat, just give us a call on 0131 229 4001 or email us at [email protected].