Our experience of Edinburgh’s private rental market over Q2 2019 has seen a welcome return to expected levels of performance, following a longer-than-usual seasonal slowdown.

We believe it’s important to understand how the private rental market is performing as a whole in the city, as well as in comparison to Scotland overall. Citylets’ report on Scotland’s private rental market performance provides detailed data. Here we take a look at:

- Scotland’s private rental market performance

- How the PRS is performing in Edinburgh

- At Home In Edinburgh’s experiences over Q2 2019

- Is Edinburgh still offering strong property investment opportunities?

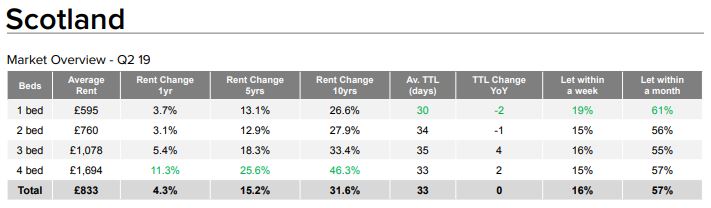

The private rental market in Scotland

The Citylets report found that the current political uncertainty surrounding Brexit has yet to make any significant impact on Scotland’s private rental market. Three and four-bed properties have made the highest gains year-on-year, reflecting the seasonal student demand for larger properties.

- The average time to let (TTL) is 33 days, matching the TTL in Q2 2018 and four days faster than the first quarter of 2019.

- There has been an increase in average rent to a record £833, up 4.3% on this time last year.

- 57% of properties are let within a month – a 6% increase year on year.

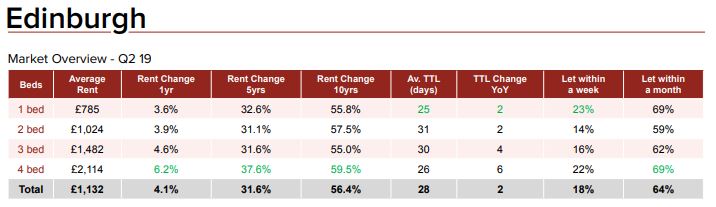

The private rental market in Edinburgh

Citylets’ report found that the agent concerns earlier this year of a slowdown have reduced, however the easing of annual growth and the increasing lag on TTL year on year could be an early indicator that rental values will begin to level off or lower.

- The average TTL is 28 days, down 2 days from the first quarter of this year but up by 2 days on Q2 2018.

- Average rents have increased by 4.1% year on year, to a new all-time high of £1,132 per month.

- 64% of properties are let within a month – down from 67% for the same quarter last year but a 3% increase on Q1 2019. 18% properties are let within a week, a 1% increase on Q1 2019.

The highest year on year rent increase is for 4-bed properties, at 6.2%, with 3-bed properties presenting the second highest increase at 4.6%.

Despite the new record high in average rent, the percentage of properties let within a week and let within a month has decreased across all property sizes on Q2 2018. 1-bed properties continue to move the fastest, with an average TTL of 25 days. This quarter, 4-bed properties have also moved quickly, with an average 26 days TTL.

Our experiences: At Home In Edinburgh

Long term lettings

Rick McCann, At Home In Edinburgh’s Director, advised that after the longer-than-usual seasonal slowdown, tenant demand made a marked increase after Easter. By the end of Q2, levels of demand were back to those experienced in this quarter in previous years.

Our average TTL was 16 days, matching Q1 2019, and remaining almost half of the Edinburgh TTL average. We feel this is a reflection on the quality of properties we manage, setting the correct rent levels, the resources we put into marketing properties and the tenants that we attract.

Our supply of long term let properties also increased over the quarter, with 25% more properties coming to market in Q2, compared to Q1. This was driven by two factors; firstly, we saw an increase in ‘let-only’ activity. Secondly, our student tenants have been giving notice earlier this year as they are no longer tied into a fixed term under the new PRT model.

Short term lettings

As you might imagine, in Q2 we were focused on maximising occupancy for our landlords with Festival let properties and preparing for the usual busy August.

Increased interest in property investment

We have seen an increase in the number of foreign buy to let investors looking to invest in property in Edinburgh, encouraged by the low pound and continued capital growth offered.

Is Edinburgh’s private rental market still offering good investment opportunities?

Our expert property team advise that Edinburgh continues to offer a sound opportunity for property investment. The private rental market remains stable, continuing high rental yields offer strong ROI and there is a continuing increasing trend in long term capital growth.

Scotland’s capital is a thriving city, appealing to a number of markets. As the UK’s second financial centre (after London) and with a booming business economy, Edinburgh attracts professionals from all over the world. Business growth is predicted to continue, particularly in areas such as technology, AI and data innovation. The city’s world-renowned universities attract a large student population, creating a high level of demand for accommodation.

Tourism remains a main-stay of Edinburgh’s economy, with the city attracting visitors from all over the globe. Dubbed the ‘Athens of the North’, Edinburgh has a reputation as the culture capital of Scotland; add this to the pull of Edinburgh’s year-round festivals – including the Festival Fringe and Edinburgh’s Christmas – and it’s easy to understand why Edinburgh is the most-visited city in Scotland.

Private rental market opportunities for investors

We continue to advise that the greatest investment opportunities within Edinburgh currently are 1-bed properties, where demand continues to surpass supply. This has been highlighted over 2019.

We can help potential investors identify sound investment properties with our free, no-obligation, Buy-to-Let Assessment service. This gives an honest, expert assessment of a property’s potential for long term lets on a PRT and short term lets on a holiday let contract. Our friendly, professional team is always happy to help, so if you’d like an informal chat just give us a call on 0131 229 4001 or email us at [email protected].